Explore Our Courses

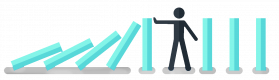

Planning and Risk Assessment

14 HoursFixed Assets Management and Control

14 HoursProject Risk Management

7 HoursLast Updated:

Testimonials(2)

workshops, open discussion

Renata Ostrowska - BFF Polska S.A.

Course - Planning and Risk Assessment

Hakan was very enthusiastic and knowledgeable

Hugo Perez - DENS Solutions

Course - Project Risk Management

Provisional Upcoming Courses (Require 5+ participants)

Online Risk Management courses, Weekend Risk Management courses, Evening Risk Management training, Risk Management boot camp, Risk Management instructor-led, Weekend Risk Management training, Evening Risk Management courses, Risk Management coaching, Risk Management instructor, Risk Management trainer, Risk Management training courses, Risk Management classes, Risk Management on-site, Risk Management private courses, Risk Management one on one training